Related Content

Related Content

Tips

Tips

Delegate, delegate, delegate

Hire qualified people who want the ball. Put the right people in place, set very detailed goals, and then take the time and put tools in place to guarantee accountability. Learn more.

Passion

"You can end up spending a lot of time trying to convince people of your vision, or you can use that same energy to go do it. How much time are you investing to get buy-in from other people? Instead of trying to bring people over to your point of view, you can instead go out and just start DOING that thing that you're passionate about." -- Mario Armstrong

Know your front door

Every business owner can tell you which door a walk-in customer came through; the same should be true for their online extension. Understand how people engage with your business by incorporating analytics and tracking tools into your website and mobile apps, such as Google Analytics.

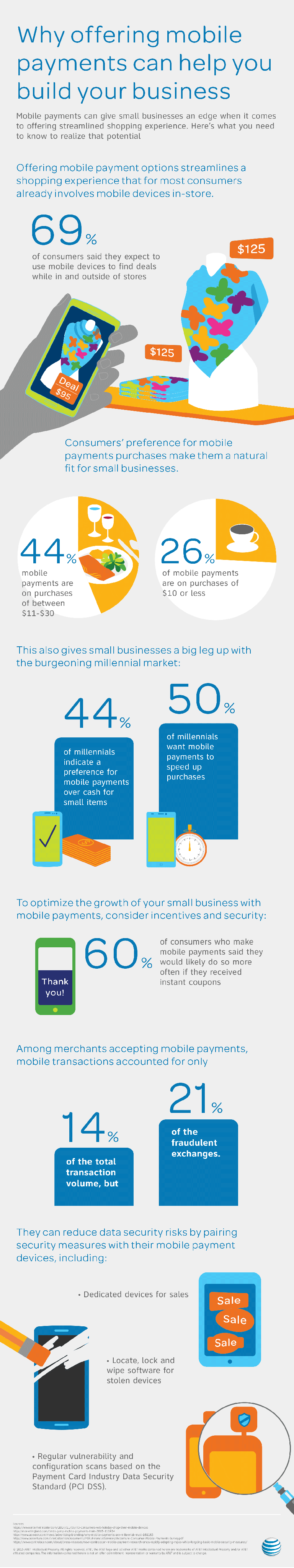

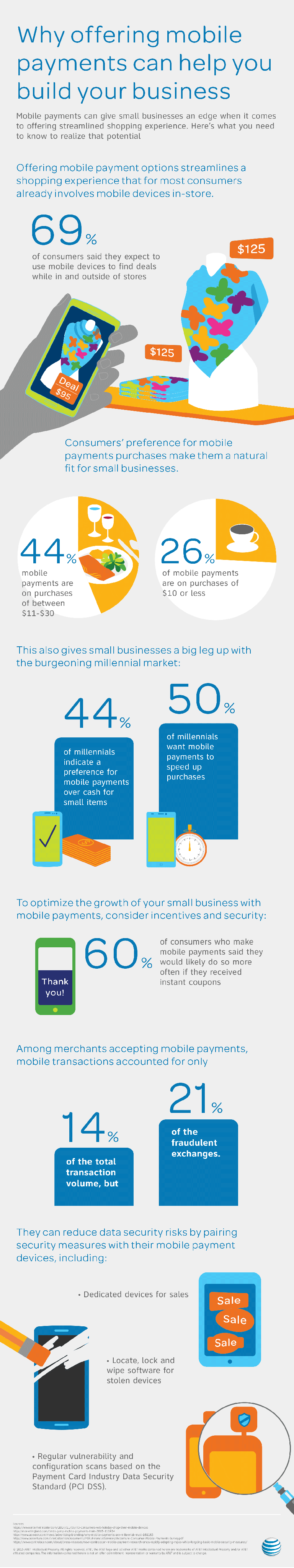

Consumers have embraced digital wallets and mobile payments such as PayPal®, Apple Pay®, Google Wallet™ payment service, and Groupon®. Small businesses that want to satisfy customers would be wise to ride the wave.

Consumers already use their smartphones for just about everything, including searching for deals while shopping. Most consumers (69 percent) said they expect to use mobile devices to find deals while in and outside of stores. If you accept mobile payments, you’re giving your business a competitive edge.

Millennials in particular love mobile payments; about half surveyed said they use them to speed up purchases. About 44 percent of millennials also indicated a preference for mobile payments over cash for small items. Mobile payments, in fact, are most frequently used for low-cost items. About 26 percent of mobile payments are on purchases of $10 or less; 44 percent of them are on purchases between $11-30.

Want to make customers smile? About 60 percent of consumers who make mobile payments said they would be more inclined to do so if they received instant coupons.

As with any technology, your business runs the risk of fraudulent transactions. Stay safe by establishing dedicated sales devices for mobile payments, using “locate, lock, and wipe” software in the event of stolen devices, and setting up regular vulnerability and configuration scans.

Related Content

Related Content

Tips

Tips

Review your tech tools

The end of the year is a good time to evaluate your technology and see how you might improve your or your employees’ productivity. Ask your staff about tech upgrades they may need, and talk with your IT staff or tech consultant about changes that could boost overall efficiency. This article can help you assess your business technology.

Get on the fast track to productivity

Available for years as a native functionality in some handsets, Push-to-Talk (PTT) technology is now available in a variety of smartphone apps. Simplify operations and save time and money with near-instant, one-to-one or one-to-many voice communication.

Create a pocket office

Staying connected on the go is critical to your success, as flexibility is one of the key advantages small businesses have over their larger counterparts. Create a good mobility plan that includes the appropriate mobile devices, data and file sharing options for your operations. Learn more.

This topic contains 0 replies, has 1 voice, and was last updated by Inc. . 6 days, 14 hours ago.